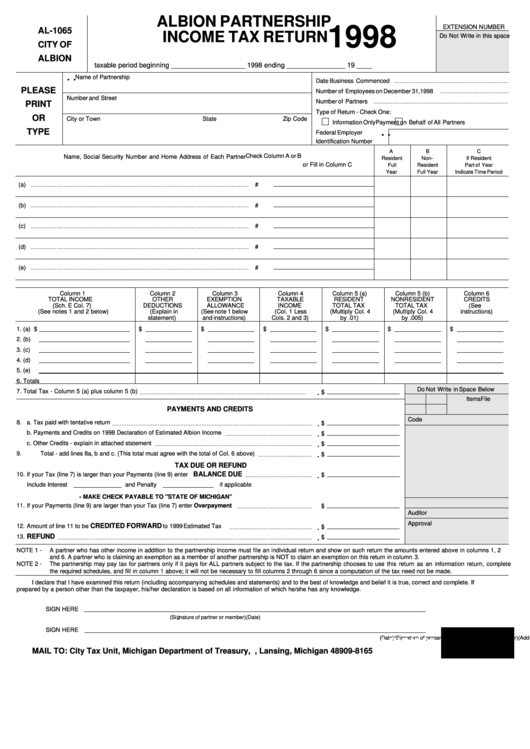

Sample W2 Template (Excel File) using the Accepted Electronic W-2 Formats listed in the document above. 2022 EL-1120 Instructions: Corporation Return Instructions (PDF)Įmployer Withholding After submitting their completed EL-SS-4, employers can use the City of East Lansing's new Employer Withholding Tool to set up their withholding tax account and complete their withholding tax reporting and payment.2022 EL-1120 Return: Corporation Return (PDF).EL-6-IT Notice of Change or Discontinuance.2022 EL-1065 Instructions: Partnership Return Instructions (PDF).2022 EL-1041 Return - Trust Return (PDF) Description:Sample Schedule-K Forms for business related income as the result of business tax return Forms 1065, 1120, and 1041.EL-1040X Amended Income Tax Return Payment Voucher (PDF).When you make a big purchase, its value may be too largeaccording to IRS rulesto write off all in one year. EL- 1040X Amended Income Tax Return (PDF) Depending on your business structure, you list your depreciation deduction each year on Form 1040 (Schedule C), Form 1120 / 1120S, or Form 1065.EL-1040X Instructions for Amended Individual Income Tax Return (PDF).EL-2848 Power of Attorney Authorization (PDF) The United States Internal Revenue Service uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income.

2022 EL-1040 Individual Return pages 1-2 (PDF).

0 kommentar(er)

0 kommentar(er)